The United States Immigration and Citizenship Services (“USCIS”) has published its quarterly performance data for Form I-526, Immigrant Petition by Alien Investor and Form I-829, Petition by Entrepreneurs to Remove Conditions on Permanent Resident Status. The number of I-526 petition filings are not much of a surprise and the painfully low number of adjudications continues to disappoint.

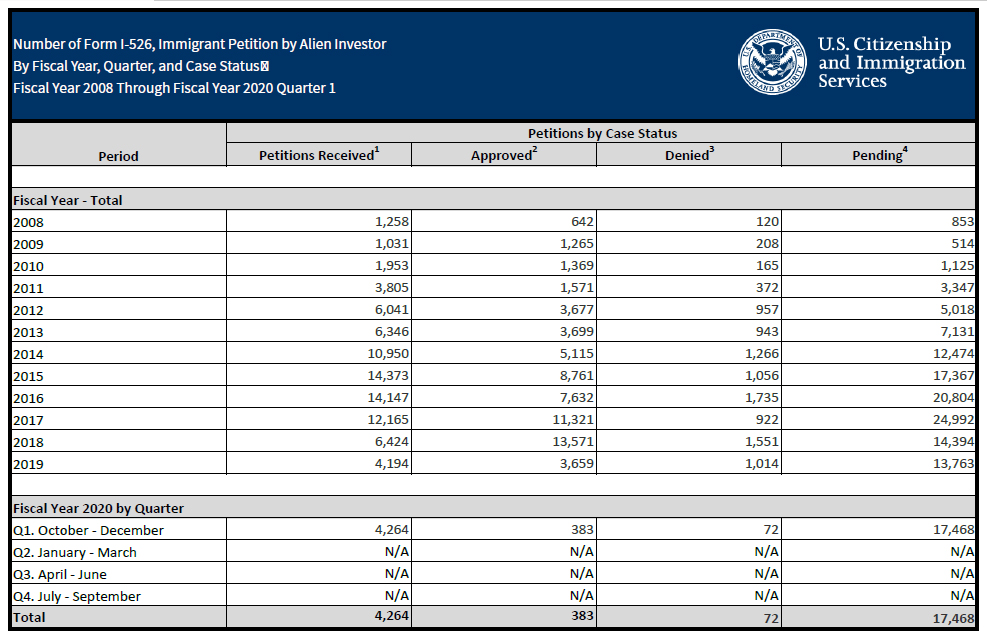

The U.S. fiscal year (“FY”) is from October 1st to September 30th each year. The USCIS received 4,264 I-526 petitions during the first quarter of FY2020, between October and December 2020. These are numbers not seen since the 2015 to 2017 period when mainland China investors were filing thousands of petitions per quarter. Compare this to the fiscal year 2019, which had only 4,194 petitions filed.

Form I-526 Immigrant Petition by an Alien Investor Filings

This renewed increase in filings is a direct result of the implementation of the “EB-5 Immigrant Investor Program Modernization Rule” that became effective on November 21, 2019. The most important change from this rule for investors was the increase of the standard investment amount to US$1.8 million, and an increase to US$900,000 for investments made in a targeted employment area. The rush by investors to invest and file petitions before the investment increase resulted in this spike in petition filings. Consequently, presuming anyone and everyone that was considering applying for an EB-5 immigrant visa rushed in before the increase, we expect to see in the FY2020-Q2 a dramatic drop in the number of petition filings..

What is disappointing, or even disturbing, is that the USCIS only adjudicated 455 I-526 petitions during those three months. If that rate continues, it will result in fewer adjudications in a full year since 2008 when the EB-5 program was still relatively unknown and the USCIS had few, but adequate, examiners.

The number of I-829 petitions adjudicated is equally disappointing and the number of pending petitions continues to rise, forcing ever longer waiting times for those investors and their family members to be granted full unconditional permanent residence.

Form I-829 Petition by Entrepreneurs to Remove Conditions on Permanent Resident Status.

Through most of 2019 the Investor Program Office (“IPO”) Chief Sarah Kendall promised that the IPO would improve its processing of petitions, most recently, during a Stakeholders Meeting on March 13, 2020. Unfortunately, we did not see this at the end of 2019 and will not see any data on whether it has done so until the end of the summer, at the latest. Is this slow down on processing yet another example of the anti-immigration sentiment of the current administration? To make matters worse, we must expect processing to be further affected by the COVID-19 although we wonder how the processing time could slow down even more.

If you have any questions about the EB-5 immigrant investor visa, contact us at info@enterlinepartners.com and speak with one of our U.S. immigration lawyers in Asia at our offices in Ho Chi Minh City, Manila and Taipei.

ENTERLINE & PARTNERS CONSULTING

Ho Chi Minh City, Vietnam Office

3F, IBC building

1A Cong Truong Me Linh Str.

District 1, HCMC, Vietnam

Tel: +84 933 301 488

Email: info@enterlinepartners.com

Facebook: Enterline & Partners – Dịch vụ Thị thực và Định cư Hoa Kỳ

Website: http://enterlinepartners.com

Manila, Philippines Office

Unit 2507 Cityland 10 Tower 1

156 H.V. Dela Costa Street

Makati City, Philippines 1209

Tel: +632 5310 1491

Email: info@enterlinepartners.com

Facebook: Enterline and Partners Philippines

Website: https://enterlinepartners.com/language/en/welcome/