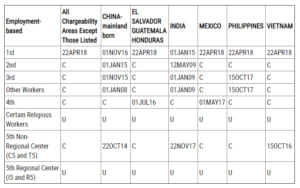

The final action dates for the I5 and R5 categories have been listed as “Unavailable” in the Department of State visa bulletin for October 2019. This is because the EB-5 Immigrant Investor Program is currently set to expire on September 30, 2019. The C5 and T5 categories remain with published priority dates because these are “direct” (non-regional center) EB-5 visas which are permanent law.

If there is legislative action extending the immigrant investor program into fiscal year 2020 (beginning October 1, 2019), the final action dates will most likely immediately become “Current” for October for all countries except China-mainland born applicants.

If there is legislative action extending the immigrant investor program into fiscal year 2020 (beginning October 1, 2019), the final action dates will most likely immediately become “Current” for October for all countries except China-mainland born applicants.

The Dates for Filing (Table B) remains current for Vietnam investors which has generally been the norm (see “All Chargeability Areas except those listed”).

EB-5 visas available for Vietnamese in fiscal year 2019 were all used up by the end of July this year and the priority date for Vietnamese investors retrogressed to October 22, 2014, and remained so through August and September. With a new 10,000 EB-5 visas available at the beginning of the fiscal year (October 1st) we expect the priority date for Vietnamese investors to move forward in October, once the immigrant investor program is extended. We will probably not see this movement until the November bulletin.

If you have any questions about the visa bulletin, priority dates, the EB-5 visa or other U.S. visas, please contact us at