Most of my clients ask me this question and there is a lot of confusion about the processing times visa waiting times.

As a refresher, there is a 3-step process to obtaining lawful permanent residence in the U.S. via the EB-5 immigrant investor visa category. First, an investor files a Form I-526 Petition (“Petition”) with the United States Citizenship and Immigration Service (“USCIS”). Once the Petition is approved, an investor and family may then proceed to the visa application step, or if the investor is in the United States, he or she may be eligible for Adjustment of Status. The third step is to file the Form I-829 Petition between the 21st and 24th month of the investor’s Conditional Permanent Residence period to remove the “condition” from the investor’s resident status.

So how long does it take to obtain approval for step 1, the I-526 Petition stage?

There are generally 3 ways you can estimate the average processing time for Petitions.

1. Check with an experienced EB-5 attorney – First, you can check with an EB-5 attorney that represents many investors in many EB-5 projects (such as Enterline and Partners) to find out the actual average time in which Petitions are approved. It is important that the lawyer represents investors in more than just a few projects because some projects may experience different processing times for the Petitions.

Some projects may have faster processing of Petitions once a batch has been approved for that specific project. This would change the processing time to appear shorter than the average of all Petitions. On the other hand, Petitions that have been filed for a project that has not yet had an approved Petition, may take considerably longer to receive its initial approval, changing the processing time to appear longer than the average of all Petitions. A lawyer that files many Petitions in many different projects should be able to see the average processing times across all Petitions, not just in a few projects.

2. The USCIS Check Case Processing Times page – The USCIS maintains a page in which petitioners may check the posted processing time averages {Check Case Processing page}

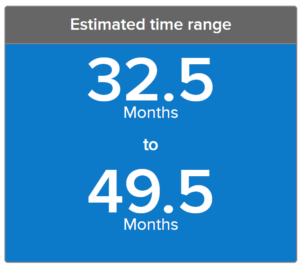

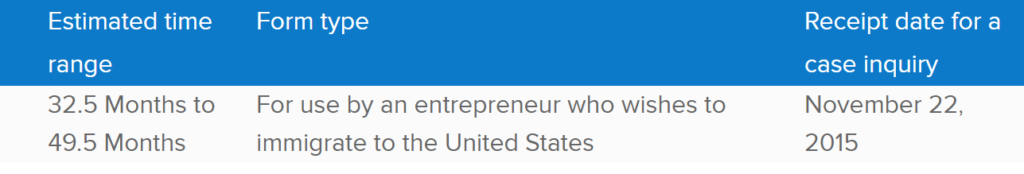

To use this page, select the Petition type (I-526) and choose the Field Office or Service Center. Note that only the Immigrant Investor Program Office is available for the I-526 Petition. Click “Get Processing Time”. The results will show like this:

Processing time for Immigrant Petition by Alien Entrepreneur (I-526) at Immigrant Investor Program Office

According to this information, (the first week of January 2020), it is taking an average of 32.5 to 49.5 months for USCIS to approve a Petition. This is of course well over 2 years for the earliest approvals. However, there are some underlying reasons why this posted processing time is so long which makes this not very accurate.

USCIS requests that petitioners and especially lawyers do not follow up with Petition status requests if a Petition is within the posted processing time. Once a Petition is 30 days outside of a posted processing time, then USCIS will respond to requests made about specific Petitions. If the Petition is within this posted processing time, USCIS will simply advise the inquirer that the Petition is within the posted processing time and to please be patient. Extending the posted processing time over such a long period curtails petitioners and lawyers from making inquiries until a Petition has been pending for years.

This also frustrates a petitioner that wants to file a Writ of Mandamus. A Writ of Mandamus is an order from a court to a government agency requiring that the relevant agency or official properly fulfill its official duties or correct an abuse of discretion. In the case of a Petition that has been pending for a long time, a Writ of Mandamus is asking the court to demand that USCIS make a decision on a Petition. If the Petition is still within the posted processing time, the court may decide not to approve the Writ. Based on these reasons, the posted processing times here are a strategic tactic by USCIS to reduce the number of inquiries sent to USCIS about Petitions and curtail the use of the Writ of Mandamus.

3. Historical National Average Processing Time for All USCIS Offices

The third method of estimating the average processing time of a Petition is to check the “Historical National Average Processing Time for All USCIS Offices” page on the website {Historical Average Processing page}

This page lists the average processing times over the last few years. The table below shows that in Fiscal Year (“FY”) 2019, the average processing time for an I-526 Petition was 19.8 months.

As an average, this is much closer to what we see in reality.

So what do we see as an accurate average processing time? We see Petitions that are filed in projects that already have approvals taking as little as 12-15 months. We see Petitions that are filed with projects that do not yet have an approval taking around 24-30 months. Of course these are, again, averages, and the odd Petition that is approved in less than 12 months, or is still pending after 36 months, is common.

If you have questions about the EB-5 visa category of processing times, please contact us at: