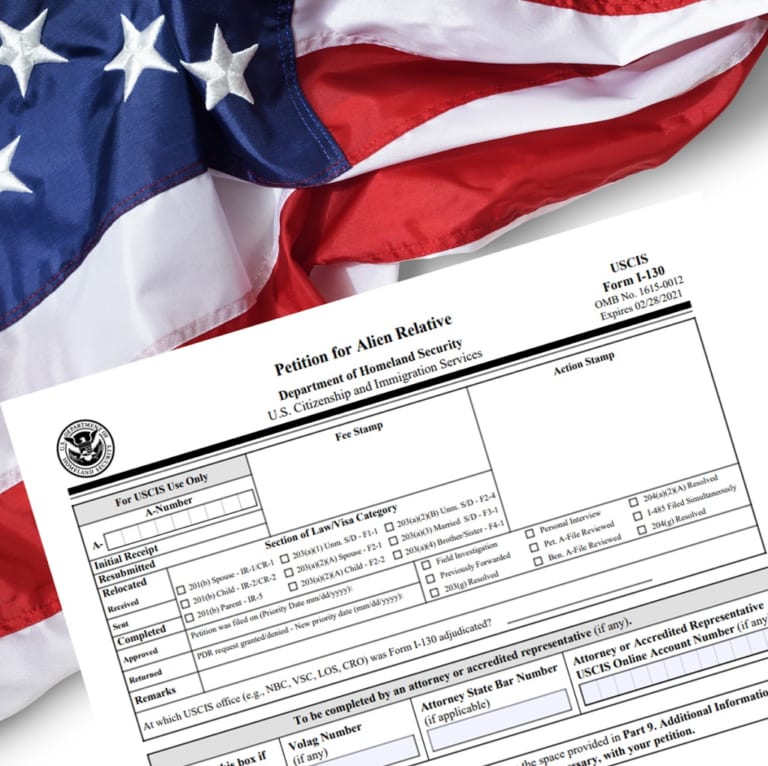

Filing a family based immigrant petition for a foreign spouse is one of the most commonly applied for U.S. immigration benefits. The Form I-130, Petition for Alien Relative (“Form I-130”), filed with the United States Citizenship and Immigration Services (“USCIS”) is used by U.S. citizens and lawful permanent residents (“Green